Life insurance is an important financial safety net that can provide a financial cushion for your loved ones in the event of your unexpected death. In the past, getting life insurance required taking a medical exam, which could be a deterrent for some people. However, with the advent of no exam life insurance, obtaining life insurance has become easier and more accessible. In this article, we will explore the pros and cons of no exam life insurance and help you determine whether it is the right option for you.

1. What is No Exam Life Insurance?

No exam life insurance, also known as non-medical life insurance, is a type of life insurance policy that does not require a medical exam or any physical tests. Instead, the policy is issued based on the answers provided on the application and a review of your medical records.

2. How Does No Exam Life Insurance Work?

With no exam life insurance, you simply fill out an application and answer some health questions. The insurer then assesses your risk based on your age, health history, and the answers you provided on the application. This allows the insurer to determine whether you are eligible for coverage and, if so, at what rate.

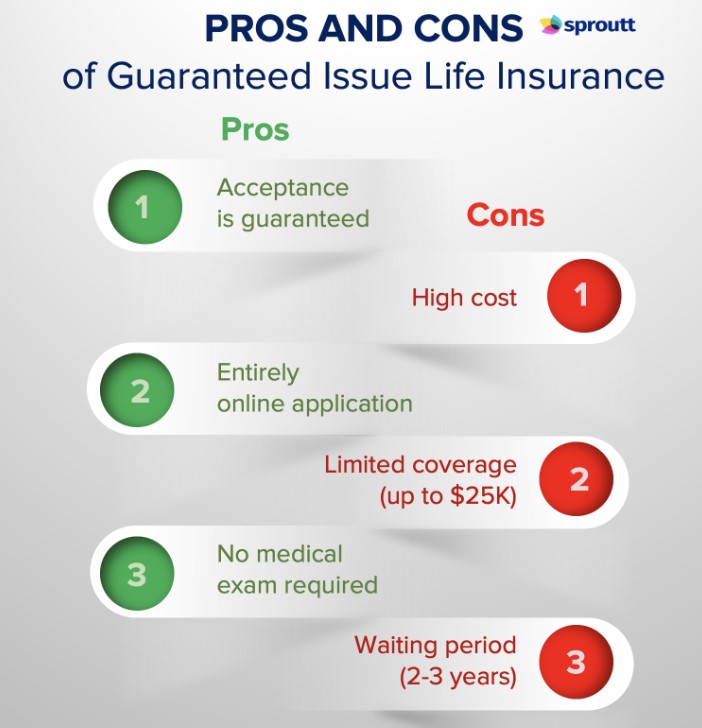

3. Pros of No Exam Life Insurance

– Convenience

One of the main benefits of no exam life insurance is the convenience it offers. With no medical exam required, you can apply for coverage quickly and easily from the comfort of your own home.

– Accessibility

No exam life insurance is also more accessible than traditional life insurance policies. This is because people who may not qualify for traditional life insurance policies due to pre-existing health conditions or lifestyle factors, such as smoking or obesity, may still be able to get coverage through a no exam policy.

– Quick Approval

Since no exam life insurance policies don’t require a medical exam, they are typically approved more quickly than traditional life insurance policies. In some cases, you can even get approved within minutes.

– No Needles or Medical Exams

For some people, the thought of undergoing a medical exam can be intimidating or uncomfortable. With no exam life insurance, there With no exam life insurance, there are no needles or physical tests involved, making it a more attractive option for those who have a fear of medical procedures.

– High Acceptance Rate

No exam life insurance policies have a high acceptance rate, which means that more people are likely to be approved for coverage. This can be beneficial for those who may not be able to get approved for traditional life insurance policies.

4. Cons of No Exam Life Insurance

– Higher Premiums

One of the main drawbacks of no exam life insurance is that the premiums can be higher than those of traditional life insurance policies. This is because the insurer is taking on more risk by not conducting a medical exam to determine the applicant’s health status.

– Limited Coverage Amount

No exam life insurance policies typically offer lower coverage amounts than traditional life insurance policies. This means that if you need a higher amount of coverage, you may need to purchase multiple policies.

– No Customized Policies

With no exam life insurance, you are limited to the policies that are available, which may not meet your specific needs. For example, if you want a policy with a specific term length or a particular rider, you may not be able to find it with a no exam policy.

– Limited Riders

No exam life insurance policies typically have fewer rider options than traditional policies, which means that you may not be able to add on additional coverage for things like accidental death or disability.

– Potentially Higher Risk for Insurer

Since no exam life insurance policies do not require a medical exam, the insurer is taking on more risk by offering coverage based solely on the answers provided on the application. This means that the premiums may be higher to compensate for the increased risk.

5. Who Should Consider No Exam Life Insurance?

No exam life insurance can be a good option for people who need coverage quickly, who have pre-existing health conditions, or who are unable to undergo a medical exam. It can also be a good option for people who want to avoid the hassle of a medical exam or who have a fear of medical procedures.

6. How to Choose the Right No Exam Life Insurance Policy?

When choosing a no exam life insurance policy, it’s important to consider factors such as the coverage amount, the premiums, and any riders or additional coverage options that may be available. It’s also important to compare policies from multiple insurers to ensure that you are getting the best coverage for your needs at a price that you can afford.

7. How Much Coverage Do You Need?

The amount of coverage that you need will depend on your individual circumstances, such as your age, your income, and the needs of your dependents. A good rule of thumb is to aim for coverage that is at least 10 times your annual income.

8. How to Apply for No Exam Life Insurance?

To apply for no exam life insurance, you will need to fill out an application and answer some health questions. The insurer will then review your application and medical records to determine whether you are eligible for coverage and, if so, at what rate.

9. Frequently Asked Questions

– What is the difference between no exam life insurance and traditional life insurance?

The main difference between no exam life insurance and traditional life insurance is that no exam policies do not require a medical exam or physical tests. Instead, the policy is issued based on the answers provided on the application and a review of your medical records.

– Can you get a large coverage amount with no exam life insurance?

No exam life insurance policies typically offer lower coverage amounts than traditional life insurance policies. If you need a higher amount of coverage, you may need to purchase multiple policies.

– How do you know if no exam life insurance is right for you?

No exam life insurance may be right for you if you need coverage quickly, have pre-existing health conditions, or have a fear of medical procedures. It’s also a good option if you are unable to undergo a medical exam or if you want to avoid the hassle of a medical exam.

– Can you convert no exam life insurance into a traditional life insurance policy?

In some cases, it may be possible to convert a no exam life insurance policy into a traditional life insurance policy. However, this will depend on the specific policy and insurer, so it’s important to check with your insurer to see what options are available.

– Can you cancel a no exam life insurance policy?

Yes, you can cancel a no exam life insurance policy at any time. However, it’s important to note that if you cancel your policy, you may not be able to get the same coverage or premiums if you decide to reapply for coverage in the future.

Conclusion

No exam life insurance can be a convenient and accessible option for people who need life insurance coverage quickly or who are unable to undergo a medical exam. However, it’s important to weigh the pros and cons before making a decision, as no exam policies typically have higher premiums and lower coverage amounts than traditional policies. Ultimately, the right life insurance policy for you will depend on your individual needs and circumstances.

Read More :

- The Importance of Car Insurance for Drivers : Protecting Yourself and Others

- The Pros and Cons of Bundling Home and Auto Insurance

- Life Insurance for Seniors : Coverage Options for Older Adults

- The Best Life Insurance Companies : Ratings, Reviews, and Rankings

- The Different Types of Car Insurance : Liability, Collision, and Comprehensive

- How to Save Money on Car Insurance Premiums : Tips and Tricks