When it comes to choosing a life insurance policy, you have a lot of options to consider. Two of the most popular types of life insurance are term life insurance and whole life insurance. While both offer important benefits, they have some key differences that can make one more suitable for you than the other. In this article, we will explore the differences between term life and whole life insurance and help you decide which one is the right choice for you.

1. What is Term Life Insurance?

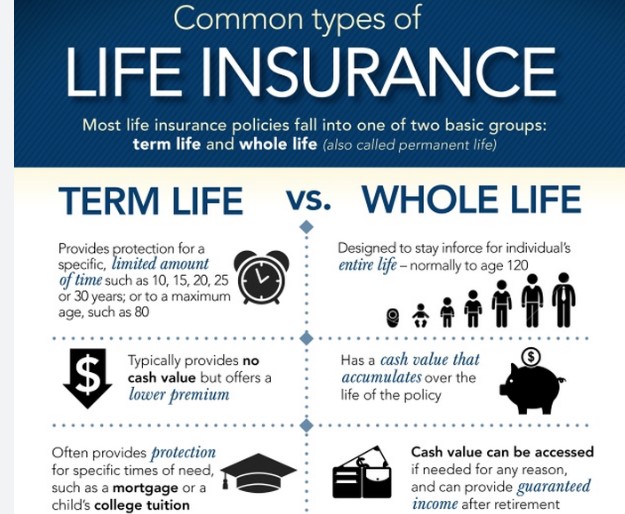

Term life insurance is a type of life insurance policy that provides coverage for a specific period of time, usually between 10 and 30 years. If the policyholder dies during the term of the policy, the death benefit is paid out to the beneficiary. If the policyholder outlives the term of the policy, the policy expires and there is no payout.

2. What is Whole Life Insurance?

Whole life insurance is a type of life insurance policy that provides coverage for the entire life of the policyholder. Unlike term life insurance, whole life insurance policies do not expire as long as the policyholder continues to pay the premiums. Whole life insurance also has a cash value component that accumulates over time and can be borrowed against or used to pay premiums.

3. The Cost of Term Life Insurance vs Whole Life Insurance

Term life insurance is typically less expensive than whole life insurance because it provides coverage for a limited period of time. With term life insurance, you are only paying for the death benefit and not accumulating any cash value. On the other hand, whole life insurance provides coverage for the entire life of the policyholder and includes a cash value component, which makes it more expensive.

4. Term Life Insurance Pros and Cons

Pros:

- Affordable premiums

- Simple and easy to understand

- Provides coverage for specific needs, such as paying off a mortgage or funding a child’s education

Cons:

- Coverage is limited to a specific period of time

- No cash value component

- Premiums may increase when the policy is renewed

5. Whole Life Insurance Pros and Cons

Pros:

- Provides coverage for the entire life of the policyholder

- Includes a cash value component that can be borrowed against or used to pay premiums

- Premiums are typically guaranteed and will not increase

Cons:

- More expensive than term life insurance

- Cash value accumulation may be lower than other investment options

- Policyholder may need to pay premiums for a longer period of time

6. How to Choose Between Term

Choosing between term life and whole life insurance can be a difficult decision. The right choice will depend on your individual needs and circumstances. Here are some factors to consider when deciding between term life and whole life insurance:

- Budget: If you have a limited budget, term life insurance may be the more affordable option.

- Coverage needs: If you only need coverage for a specific period of time, such as while your children are young or until your mortgage is paid off, term life insurance may be the best choice.

- Long-term goals: If you are looking for a policy that will provide coverage for your entire life and has a cash value component that can be used for long-term financial planning, whole life insurance may be a better fit.

- Investment preferences: If you prefer to invest your money in other types of investments, such as stocks or real estate, term life insurance may be a better choice for you.

- Estate planning: If you are looking to leave an inheritance to your beneficiaries or need to pay estate taxes, whole life insurance may be a better option.

7. When Term Life Insurance is the Best Option

Term life insurance is the best option when you have a specific need for coverage, such as paying off a mortgage or funding a child’s education, and want an affordable policy that provides coverage for a limited period of time. Term life insurance is also a good option for those who have a limited budget or prefer to invest their money in other types of investments.

8. When Whole Life Insurance is the Best Option

Whole life insurance is the best option when you want a policy that provides coverage for your entire life and has a cash value component that can be used for long-term financial planning. Whole life insurance is also a good option for those who are looking to leave an inheritance to their beneficiaries or need to pay estate taxes.

9. How Much Life Insurance Coverage Do You Need?

Determining how much life insurance coverage you need can be a complex process. The amount of coverage you need will depend on a variety of factors, including your income, debts, and financial goals. A general rule of thumb is to have coverage that is equal to 10-12 times your annual income. However, it is important to work with an insurance agent or financial advisor to determine the right amount of coverage for your individual needs.

10. Buying Term Life Insurance vs Buying Whole Life Insurance

Buying term life insurance is typically a simpler process than buying whole life insurance. Term life insurance policies are straightforward and easy to understand, and the application process is usually quick and easy. Whole life insurance policies are more complex, and the application process may involve a medical exam and more detailed financial information.

11. The Benefits of Working with an Independent Insurance Agent

Working with an independent insurance agent can be beneficial when shopping for life insurance. Independent agents work with multiple insurance companies and can provide you with a variety of policy options to choose from. They can also help you determine how much coverage you need and find a policy that fits your budget.

12. The Top Life Insurance Companies

There are many life insurance companies to choose from, and it can be difficult to know which ones are the best. Some of the top life insurance companies include:

- Northwestern Mutual

- New York Life

- MassMutual

- State Farm

- Guardian Life

13. Frequently Asked Questions about Term Life and Whole Life Insurance

- What is the difference between term life insurance and whole life insurance?

- How much life insurance coverage do I need?

- How do I choose between term life and whole life insurance?

- How much does life insurance cost?

- Can I change my life insurance policy if my needs change?

14. Conclusion

When it comes to choosing between term life insurance and whole life insurance, there is no one-size-fits-all answer. The right choice will depend on your individual needs and circumstances. Term life insurance is a good option if you need coverage for a specific period of time and want an affordable policy. Whole life insurance is a good option if you want coverage for your entire life and want a policy with a cash value component. It’s important to work with an independent insurance agent to determine the right amount of coverage for your individual needs and find a policy that fits your budget.

15. References

- Investopedia. (2021). Term Life Insurance vs. Whole Life Insurance. Retrieved from https://www.investopedia.com/terms/t/termlife.asp

- NerdWallet. (2021). Term Life vs. Whole Life Insurance: How to Choose. Retrieved from https://www.nerdwallet.com/article/insurance/term-life-vs-whole-life-insurance

- Forbes. (2020). Best Life Insurance Companies 2020. Retrieved from https://www.forbes.com/advisor/life-insurance/best-life-insurance-companies/

Read More :